Claim: Deaths of all causes increasing insurance companies say.

And also 'morbidities' - that is, illnesses. And it looks as though it might be the Covid vaccinations causing this.

Are deaths of all causes increasing? Yes, and it looks like the Covid vaccines might be causing it.

According to the figures from two large life insurance companies, OneAmerica and Lincoln National Life Insurance, deaths by all causes have been increasing, excluding Covid deaths.

Deaths by all causes increased in 2021 by around 40%.

Whilst some websites point out that Lincoln Nationals payouts for death benefits increased by 163% in 2021 (the actual figure is closer to 164%), they also had more customers in 2021. When taking into account the extra policies that they sold in 2021, the increase in deaths appears to be closer to OneAmerica’s figure of 40%.

Scott Davison CEO of OneAmerica, said deaths were up 40% among working aged people in 2021

Scott Davison, the CEO of OneAmerica, a $100 billion insurance company based in Indianapolis since 1877, said in an online news conference on December 30, 2021 that deaths were up 40% among working aged people since the pandemic began.

“We are seeing, right now, the highest death rates we have ever seen in the history of this business; not just at OneAmerica. The data is consistent across every player in that business. Now this is primarily working-age people 18 to 64, in the employers on the screen here. And what we saw just in third quarter, we’re seeing it continue into fourth quarter, is that death rates are up 40% over what they were pre-pandemic,” he said. “Just to give you an idea of how bad that is, a three-sigma or a one-in-200-year catastrophe would be 10% increase over pre-pandemic. So 40% is just unheard of. And what the data’s showing us is that the deaths being reported as Covid deaths are just a fraction of showing to us is that the deaths that are being reported as COVID deaths greatly understate the actual death losses among working-age people from the pandemic. It may not all be COVID on their death certificate, but deaths are up just huge, huge numbers.”

He said at the same time, the company is seeing an “uptick” in disability claims, saying at first it was short-term disability claims, and now the increase is in long-term disability claims.

“For OneAmerica, we expect the costs of this are going to be well over $100 million, and this is our smallest business. So it’s having a huge impact on that,” he said.

A 3-sigma (standard deviation) catastrophe would be a 10% increase; apparently 40% represents a 12-sigma catastrophe. An extremely unlikely event.

These extra deaths began after Covid vaccination began in mid-December 2020, with the first Pfizer shots.

Lincoln National Fourth Quarter 2021 Payouts on deaths increased 163% in 2021; that is approximately 25-49% more deaths.

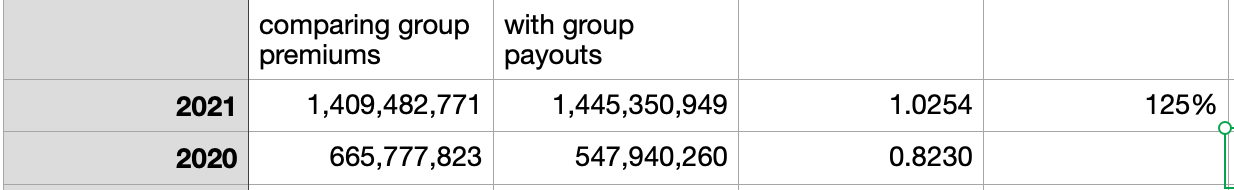

A much larger insurance company, Lincoln Nationals, reported a huge increase in payouts for non-Covid death benefits paid out in 2021 when compared to 2020; they paid out $665,777,823 in death benefits on group policies in 2020 and $1,409,482,771 in 2021. That is an increase of 163%.

However due to a greatly increased number of life insurance premiums sold in 2021, it looks as though the increase in death benefits paid out represents at least a 25-30% increase in deaths, rather than a 163% increase.

The Press release also tells us sickness increased a lot in 2021

Lincoln National Financials First Quarter 2022 press release indicated an increase in non-COVID morbidity payouts during the fourth quarter of 2021.

Group Protection reported a loss from operations of $41 million in the quarter compared to a loss from operations of $26 million in the prior-year quarter. This change was driven by non-pandemic-related morbidity, including unusual claims adjustments, and less favorable returns within the company’s alternative investment portfolio.

Morbidity means illness - a lot more people were ill during 2021 - and the increase is not Covid.

And it is true in that the Lincoln group payouts for death benefits increased by more than 163% (which is rounded down, the true figure is closer to 164% actually (163.8%) ) but we don’t actually know how many individual deaths this represents, in 2020 and 2021, and what percentage of life insurance premiums held by the company this represents, either.

The best we can do from the data available is compare the dollar value of the group premiums sold to the group payouts. This ratio gives a better indication of the increase; for it is quite clear that more people were buying life insurance premiums in 2021 than 2020, perhaps because of a fear that they may be killed by Covid.

When we calculate the increase this way, we find there was a 25% increase in payouts.

25% still represents a huge increase in the number of deaths. That means for every 8 people who died in 2020, at least 10 people died in 2021.

However when we look at all the death benefits, compared with all the life insurance premiums, there is a 29% increase.

The other thing to consider when looking at these figures is that presumably not all the life insurance premiums are purchased at the beginning of the year. Assuming that life insurance premiums are bought throughout the year, a better measure might be the mean of the previous year’s premiums and the particular year’s premiums.

This probably gives a truer picture, despite there being less premiums sold in 2020 than 2019 or 2021. This indicates an approximately 49% increase in payouts for death benefits.. The figure of 49% might be inflated slightly because of price increases in insurance; and considering that it is only a rule-of-thumb figure, it is nonetheless reasonably close to the figure of 40% that Scott Davison cited.

This is a very rare increase.

40% is apparently a 12-sigma (standard deviation) event - Davison described a 3 sigma event as one that should happen once every 300 years or so. A six sigma event should happen once every 300,000 years or so.

References

https://odysee.com/@jqrcoad:5/2022-01-04-11-28-21:a

https://www.oneamerica.com/about-us/annual-report/ar-videos/message-from-scott-davison

https://crossroadsreport.substack.com/p/breaking-fifth-largest-life-insurance

https://www.lfg.com/wcs-static/pdf/2020%20LNL%20Statutory%20Statement.pdf

https://www.lfg.com/wcs-static/pdf/2020%20LNL%20Statutory%20Statement.pdf

https://roundingtheearth.substack.com/p/why-are-non-covid-deaths-at-historic